Friday, May 28, 2010

Euro Crisis to Set One World Currency?

http://www.thedailybell.com/1084/Euro-Crisis-to-Set-One-World-Currency.html

Friday, May 28, 2010 – by Staff Report

Is Europe heading for a meltdown?... This financial crisis is worse than the sub-prime crash of 2008 because the sums are so much bigger and it is governments that are in dire straits. Edmund Conway explains the dangers. Mervyn King, the Bank of England Governor, summed it up best: "Dealing with a banking crisis was difficult enough," he said the other week, "but at least there were public-sector balance sheets on to which the problems could be moved. Once you move into sovereign debt, there is no answer; there's no backstop." In other words, were this a computer game, the politicians would be down to their last life. Any mistake now and it really is Game Over. Or to pick a slightly more traditional game, it is rather like a session of pass-the-parcel which is fast approaching the end of the line. – UK Telegraph

Dominant Social Theme: The wise men of Brussels and the courageous citizens of the EU will muddle through.

Free-Market Analysis: As the money crisis seems to grow worse in Europe, we have begun to wonder if there are parallels to the 1907 financial panic in the United States that gave rise to the Federal Reserve. The dominant social theme way back then (assuming an active power elite, and we do) was along the lines of "The US banking system is too fragmented and a lender of last resort is badly needed." JP Morgan assembled his rich friends in the library of his exquisite New York mansion and bailed out the market, but only six years later, the Federal Reserve was born, the bastard child of false market-insolvency rumors and a knobby-nosed father (Morgan, himself).

There is, in fact, still speculation today that Morgan's camp planted the initial rumors of instability that swept the market and triggered the crash of 1907. Why on earth would he do such a thing? To generate the eventual result: the creation of the Federal Reserve and its passage by the US Congress. This is one perspective, anyway, the "paranoid one" that you will not find in most mainstream history books or college texts.

Back to our larger theme. We have written in the past (see – IMF Plotting Gold Backed SDRs) that we did not see how on earth the power elite was going to get from fairly abstract monetary concepts like SDRs to an actual worldwide consensus for a more globalized currency (and a global warming – "carbon" – currency seems, as well, to be a non-starter, at least currently). In fact, we have speculated that the elite could decide on a gradualist approach, setting up a thesis/antithesis dialectic between global money and regional money to move the conversation gradually in the direction of a worldwide currency. But perhaps there is a faster way. Let us see ...

The European financial crisis started with Greece and, it's true, Greece's problems are moderate ones for the EU given its size and amount of debt. But this crisis has not been resolved despite the supposed US$1 trillion that has been set aside to discourage "wrong way" speculation in Greek debt. We saw yesterday that the larger market was up because of statements from Chinese leaders that they were not going to sell euros and were perhaps to continue to be a net purchaser. So this is what market confidence has come to: China, a rigid, neo-communist state with a raging property inflation problem is seen by "the market" as a lynchpin of the Western capitalist system. What a hoot. You can't make this stuff up.

Anyway, from our perspective, a hypothetical path to a world currency (with some speed) would involve certain very specific elements. It would include, obviously, a very serious sovereign wealth crisis spreading from country to country thoughout at least the Southern half of Europe. This crisis, hypothetically, would be averted by heroic Brussels bureaucrats but not before a significant amount of financial pain was inflicted – good and hard as H. L. Mencken might say. It might even involve the dissolution of the euro and the shrinking of the EU itself. But the pay-off for the power elite would be the ability to float a scenario that proposes a worldwide currency to avert additional difficulties going forward. Here's some more from the article excerpted above:

Strip away the details – the breakdown of the euro, the crumbling of the Spanish banking system to take just two – and what you are left with is the next leg of a global financial crisis. Politicians temporarily "solved" the sub-prime crisis of 2007 and 2008 by nationalising billions of pounds' worth of bank debt. While this helped reinject a little confidence into markets, the real upshot was merely to transfer that debt on to public-sector balance sheets.

This kind of card-shuffle trick has a long-established pedigree: after the dotcom bust, Alan Greenspan slashed US interest rates to (then) unprecedented lows, which helped dull the pain, but only at the cost of generating the housing bubble that fed sub-prime. It is not so different to the Ponzi scheme carried out by Bernard Madoff, except that unlike his hedge fund fraud, this one is being carried out in full public view.

The problem is that this has to stop somewhere, and that gasping noise over the past couple of weeks is the sound of millions of investors realising, all at once, that the music might have stopped. Having leapt back into the market in 2009 and fuelled the biggest stock-market leap since the recovery from the Wall Street Crash in the early 1930s, investors have suddenly deserted. London's FTSE 100 has lost 15 per cent of its value in little more than a month. The mayhem on European bourses is even worse, while on Wall Street the Dow Jones teeters on the brink of the talismanic 10,000 level.

It is obvious that the sovereign crisis can inflict considerable pain. And it seems to have just begun. Yet perhaps our scenario is too simplistic, too conspiratorial. We ourselves have maintained that the problems with the EU and the euro are probably in excess of whatever the elite had expected – and they did expect a crisis of this sort, one that was supposed to drive the EU into a closer political union. The idea, however, that the power elite could engage in cold-blooded manipulations of whole countries is fairly difficult to countenance. On the other hand, there are historical speculations that JP Morgan, at the height of his wealth, controlled in some sense up to half of the profitable enterprises in the United States. Wealth can be concentrated and great wealth begets wealth, especially because the current fiat money system that tends to collapse the middle class.

Assume somehow that the unrolling sovereign crisis is indeed a prelude to a fear-based promotion seeking a worldwide currency (and perhaps some sort of worldwide central bank to go along with it) and one begins to see the outlines of an especially audacious dominant social theme. Perhaps this theme would be buttressed with other fear-based promotions – local and regional wars, even confrontations that utilize small nuclear devices.

We're just speculating here, of course, for our window on power elite activities extends only to a modest comprehension of how elite promotions might operate. Yet even in stating this, we should also point out that these themes are promoted by a vast array of institutions – media properties, think tanks, NGOs and assorted non-profits, not to mention governmental entities. To accept the idea of dominant social themes is to accept that the elite has tremendous influence worldwide and especially in the West. We're past that point of course. We do accept it.

We would also point out that to try to force the issue now of a truly global currency would be audacious in the extreme. Citizens of the Anglo-American axis are up in arms over the poor economy and Europe is smoldering as well. Never has a sociopolitical awakening swept the West as it has now – courtesy of the Internet and its continual truth-telling. There is more and more anger over central banking, the West's serial wars, the over-taxation and the general dysfunction of regulatory democracy.

Does what we have proposed skirt the fringes of reality? If the powers-that-be were ready to tolerate a protracted series of sovereign crises in Europe – and it may be there is not much more to arrange -- alongside perhaps some unsettling wars, it might be possible to traumatize citizens of the West enough to make them amenable to global solution. This solution in our estimation might include the return to some sort of gold standard, but unfortunately not a market-based one. The elite would try to insist on a standard that it could in a sense control and continually manage – at least in our opinion.

Conclusion: All this is no doubt far fetched. But the Panic of 1907 and the subsequent erection of the Federal Reserve – if one accepts the relationship between the two – provides us with a template for the same sort of manipulation on a bigger scale (assuming one believes in the possibility of JP Morgan's market manipulations). However it is also true that this article itself is evidence of the difficulties that the elite would face in implementing the kind of program we have suggested. After all, if we are able to anticipate it, it has occurred to others as well. This is perhaps the elite's biggest challenge in the era of the Internet. It is most difficult to promote an audience, if it comes to that, aware of your intentions and the permutations of your strategies.

Labels:

EU,

Greece,

NYSE,

Spain,

stock market,

stock market lessons,

The US Economy,

World Economy

Wednesday, May 26, 2010

32 States Now Officially Bankrupt: $37.8 Billion Borrowed From Treasury To Fund Unemployment; CA, MI, NY Worst:

http://www.zerohedge.com/article/32-states-now-officially-bankrupt-378-billion-borrowed-treasury-fund-unemployment-ca-mi-ny-w

Submitted by Tyler Durden 05/21/2010

Courtesy of Economic Policy Journal we now know that the majority of American states are currently insolvent, and that the US Treasury has been conducting a shadow bailout of at least 32 US states.

Over 60% of Americans receiving state unemployment benefits are getting these directly from the US government, as 32 states have now borrowed $37.8 billion from Uncle Sam to fund unemployment insurance. The states in most dire condition, are, not unexpectedly, the unholy trifecta of California ($6.9 billion borrowed), Michigan ($3.9 billion), and New York ($3.2 billion). With this form of shadow bailout occurring, one can only wonder how many other shadow programs are currently in operation to fund states under the table with federal money.The full list of America's 32 insolvent states is below, sorted in order of bankruptedness (in billions of dollars):

California $6,900

Michigan 3,900

New York 3,200

Penn. 3,000

Ohio 2,300

Illinois 2,200

N.C. 2,100

Indiana 1,700

New Jersey 1,700

Florida 1,600

Wisconsin 1,400

Texas 1,000

S.C. 886

Kentucky 795

Missouri 722

Connecticut 498

Minnesota 477

Georgia 416

Nevada 397

Mass. 387

Virginia 346

Arkansas 330

Alabama 283

Colorado 253

R.I. 225

Idaho 202

Maryland 133

Kansas 88

Vermont 33

S.D. 24

Tennessee 21

Virgin Islands 13

Delaware 12

Monday, May 24, 2010

VIDEO - Fundamental & Technical Analysis of the S&P 500's Daily & Weekly Charts:

http://www.viddler.com/explore/zigzagman/videos/22/

Technical Analysis of the S&P 500's daily and weekly charts, plus a look at the important Economic and Earnings Reports due out next week...

This video is viewed best in Full-Screen Mode...Click the four arrows in the bottom right corner...Press the Escape key on your keyboard to exit back to Normal Mode...

Happy Trading this week...

zigzagman

Friday, May 21, 2010

CYCC - Cyclacel Pharmaceuticals to Report New Sapacitabine Phase 2 Interim Results in MDS at the American Society of Clinical Oncology Annual Meeting:

http://finance.yahoo.com/news/Cyclacel-Pharmaceuticals-to-pz-4081723539.html?x=0&.v=1

BERKELEY HEIGHTS, N.J., May 21, 2010 (GLOBE NEWSWIRE) -- Cyclacel Pharmaceuticals, Inc. (Nasdaq:CYCC - News) (Nasdaq:CYCCP - News) announced that new interim data from an ongoing, multicenter, Phase 2 clinical trial of oral sapacitabine, the Company's lead product candidate, will be presented at an oral poster discussion during the 2010 American Society of Clinical Oncology (ASCO) Annual Meeting in Chicago, Illinois on Monday, June 7, 2010.

The Phase 2 study is evaluating sapacitabine administered as a single agent in older patients with myelodysplastic syndromes, or MDS, after treatment with hypomethylating agents.

Oral poster discussion details are as follows:

"A randomized phase 2 study of sapacitabine in MDS refractory to hypomethylating agents"

Date/Time: Monday, June 7, 2010, 2:00 P.M. - 6:00 P.M. Eastern Time

Abstract Number: 6528

Location: E450a

Discussion time: 5:00 P.M. - 6:00 P.M. Eastern Time

Location: E354a

Sapacitabine Phase 2 study in MDS:

The MDS study is designed as a protocol amendment expanding the fully enrolled Phase 2 trial of sapacitabine in acute myeloid leukemia, or AML, to include a stratum of patients with MDS refractory to hypomethylating agents. Patients with MDS often progress to AML. The primary objective of the MDS stratum is to evaluate the 1-year survival rate of three dosing schedules of sapacitabine. Secondary objectives are to assess the number of patients who have achieved CR or CRp, PR, hematological improvement and their corresponding durations, transfusion requirements, number of hospitalization days and safety. The MDS study uses a selection design with the objective of identifying a dosing schedule which produces a better 1-year survival rate in the event that all three dosing schedules are active.

The abstract is available online at:

http://abstract.asco.org/AbstView_74_54011.html

Tuesday, May 18, 2010

The Government as Identity Thieves:

Dr. Ron Paul Tuesday, May 18, 2010

http://www.thedailybell.com/1056/Ron-Paul-The-Government-as-Identity-Thieves.html

The spotlight remains on the Greek sovereign debt crisis as the riots continue. The terms of the Greek bailout from the IMF and Eurozone countries remain contentious with citizens on all sides. Europeans hate having their governments throw public money away as much as Americans do. The Greeks are not happy about having their taxes raised while their pensions and salaries are cut. Meanwhile, it is rumored by the Financial Times, AFP and others that Greece may spend more than it saves from austerity measures on arms deals with Germany, France and the US as a potential condition of receiving bailout funds. If true, it is certainly not unprecedented for the global military industrial complex to benefit from deals made by their friends in the central banking community. After all, war is the health of the state. The last thing big government proponents want is for peace to break out in the world.

This free flow of fiat money from around the globe to Greece will not really save Greece as much as it will grant a temporary reprieve to central bankers from the consequences of their mistakes. Sadly, this will come at the expense of the Greek people and taxpayers in Europe and America. Taxpayers are of no consequence to either European or American central bankers. Even the mere desire for complete information on what they are up to in our name is rebuffed, as we saw last week in the Senate with the failure of Senator Vitter's amendment containing my language to fully audit the fed. The hubris of powerful and secretive central bankers seems to know no bounds.

If someone incurred debts against you as an individual, without your knowledge or consent, you would call it identity theft. You would call your bank for a full accounting of the debts incurred in your name, and after some verification, those debts would be declared invalid and you would not be held responsible for them. Furthermore, if the culprit was found, they would be prosecuted and sent to jail.

Not so with governments and central banks. Governments that are supposed to be of the people and for the people routinely incur debts against the people. Some governments even borrow money to oppress their citizens, and then expect them to pay for their own oppression with interest. With a fiat monetary system, the sky is the limit for how much debt a government can place on the backs of the people.

We have reached the point in the United States where the debt our government has accumulated against us is mathematically impossible to pay off. Harder times, likely due to a wave of hyperinflation, will eventually find its way to our streets and I am fearful of how Americans will react. My hope is that we will come together peacefully and help each other, and that enough of us will be aware that the blame rests securely on the shoulders of the Federal Reserve and the special interests. They should not be looked to for salvation. They should not be given more power. Rather, they should be stripped of the powers that allowed them to create this mess in the first place.

Resistance to public transparency regarding public debts should be denounced in the strongest of terms, and the central bankers that incurred them should be seen as no better than common identity thieves.

Saturday, May 15, 2010

VIDEO - Fundamental & Technical Analysis of the S&P 500's Daily & Weekly Charts:

Technical Analysis of the S&P 500's daily and weekly charts, plus a look at the important Economic and Earnings Reports due out next week...

This video is viewed best in Full-Screen Mode...Click the four arrows in the bottom right corner...Press the Escape key on your keyboard to exit back to Normal Mode...

Happy Trading this week...

zigzagman

Friday, May 14, 2010

Waddell is the Mystery Trader in Last Thursday's Market Plunge:

http://www.reuters.com/article/idUSTRE64D42W20100514

(Reuters) - A big mystery seller of futures contracts during the market meltdown last week was not a hedge fund or a high frequency trader as many have suspected, but money manager Waddell & Reed Financial Inc, according to a document obtained by Reuters.

Waddell sold on May 6 a large order of e-mini contracts during a 20-minute span in which U.S. equity markets plunged, briefly wiping out nearly $1 trillion in market capital, the internal document from CME Group Inc said.

The e-minis are one of the most liquid futures contracts in the world, providing holders exposure to the benchmark Standard & Poors 500 Index. The contracts can act as a directional indicator for the underlying stock index.

Regulators and exchange officials quickly focused on Waddell's sale of 75,000 e-mini contracts, which the document said "superficially appeared to be anomalous activity."

Gary Gensler, chairman of the Commodity Futures Trading Commission, said in congressional testimony on Tuesday that it had found one sale was responsible for about 9 percent of the volume in e-minis during the sell-off in the U.S. markets.

Gensler said there was no suggestion that the trader, who he did not identify, did anything wrong in only entering orders to sell. Gensler said data shows that the trades appeared to be a bona fide hedging strategy.

The CME document shows that during the sell-off and subsequent rally, other active traders in e-minis included Jump Trading, Goldman Sachs, Interactive Brokers, JPMorgan Chase and Citadel Group.

During the 20-minute period, 842,514 contracts in e-minis were traded while Waddell from 2 p.m. to 3 p.m. traded its contracts, CME said. The CME document did not provide a break-out of Waddell's trading during the crucial 20 minutes.

Overland Park, Kansas-based Waddell did not comment. CFTC also declined to comment.

A CME spokesman, who declined to comment on the document, said the Chicago-based futures exchange operator never discusses customer activity.

"We found no evidence of improper trading activity or erroneous trades by CME Globex customers," said CME spokesman Allan Schoenberg.

Waddell's contracts were executed at Barclays Capital and later given up to Morgan Stanley, according to the document.

CME said it spoke to representatives from both banks on May 6 and planned to speak to Waddell representatives the following day. The firm oversaw $74.2 billion in assets as of March 31.

Morgan Stanley told CME that it "did not have concerns regarding the activity," the document said, because Waddell "would typically use equity index futures to hedge macro market risk associated with the substantial long exposure of its clients."

'QUITE A SHOCK TO THE MARKET'

Gensler said the contracts were sold between 2:32 p.m. and 2:51 p.m., the height of the meltdown.

The market for e-minis on May 6 fell more than 5 percent in a little more than 5 minutes starting at 2:40 p.m. -- the height of the crash, the document said. The e-minis began to recover before stock prices turned higher.

An order the size of the Waddell contract would be a big trade to execute on a normal day, said a trader whose firm is active in S&P 500 futures market. About 50,000 contracts are typically traded in an hour, the trader said.

"To get rid of 75,000 contracts, that's a lot of trading even if the market is healthy," the trader said. "But when suddenly the market changes and there's not as many bids there to trade with, 75,000 is going to cause quite a shock to the market."

"That's an enormous position for anybody, whether it's a hedge or whether it's a trade. It's a big position, no doubt about it," the trader said.

(Additional reporting Matthew Goldstein)

(Reporting by Herbert Lash and Jonathan Spicer. Editing by Robert MacMillan)

Wednesday, May 12, 2010

Cap-and-Trade: A Scam Based on a Scam...

http://canadafreepress.com/index.php/article/23046

The Canada Free Press

By Alan Caruba

Tuesday, May 11, 2010

It is almost beyond comprehension that Sen. John Kerry (D-MA) and Sen. Joseph Lieberman (I-CT) will introduce the Cap-and-Trade Act on Wednesday, May 12th, for consideration by the Senate.

It is being passed off as a “climate bill” with provisions for more oil drilling, but it is an assault on reality, on science, on common sense, and on any future economic growth of the nation.

The nation’s prisons are filled with men still claiming to be innocent after trials filled with evidence of their guilt. Denial of the truth is their last resort and this metaphor reflects what is happening in the utterly corrupt community of “global warming” liars and their associates in the U.S. government.

Recently 225 “scientists” wrote a letter defending global warming. It was published in the journal “Science”, one of the many such publications that have become as corrupt as those at the center of the global warming scam.

Based on last November’s leaked emails among those most responsible for the data at the heart of the global warming scam, it was revealed that the United Nations Intergovernmental Panel on Climate Change had been systematically publishing false climate information and analysis.

Moreover, the photo used to illustrate the “scientists” letter was photo-shopped to show a polar bear on a small piece of ice surrounded by water. The deception included the fact that many of the signatories to the letter lack credibility. Among the first 20 listed, none work in the field of climate science.

As reported by Tony Hake of Climate Change Examiner, “Pediatric surgeons, an expert in the Maya and Olmec civilizations, a chemist that studies bacteria, and a ‘computer pioneer’ with Microsoft, an electrical engineer, the chairman of a biotechnology firm, and even an expert studying corn are but a few of the 225 experts that signed the letter.”

Dr. Gerhard Kramm, an atmospheric scientist at the University of Alaska Fairbanks, fired off a letter disputing the usual claim that human activity is causing carbon dioxide emissions that are, in turn, causing global warming. “Until today, there is no scientific evidence that an increase of the globally averaged near-surface temperature by less than one Kelvin during the last 160 years can be linked to the increase of the atmospheric concentrations of so-called greenhouse gases.”

There is no global warming. Whatever warming occurred followed the end of a mini ice age that began around 1350. Around 1850 the Earth’s temperature increased about one degree Fahrenheit to its current level.

The United Nations has been the locus of the greatest hoax perpetrated in the modern era, codified in the bogus Kyoto Protocol, an international agreement that many nations signed onto in1997. The Clinton administration signed the agreement, but did not implement it due to a Senate resolution that unanimously rejected it.

The real aim of the global warming scam is the prospect of selling “carbon credits” in exchanges around the world, in effect selling air!

Cap-and-Trade Act: Constitute the greatest tax on energy use in the history of the nation

If the Cap-and-Trade Act is passed at the urging of the Obama administration, it will constitute the greatest tax on energy use in the history of the nation and it will energize exchanges, such as the one in Chicago, set up to buy and sell the carbon credits.

As reported by Investor’s Business Daily on May 7, “The carbon trading system being pushed here has spawned crime and fraud across the pond. Cap-and-Trade is not about saving the planet. It’s about money and power, and absolute power corrupting absolutely.”

The European Emissions Trading System is a warning to America. IBD described it as “a scam built upon a scam.” British and German law enforcement authorities have been busy arresting miscreants “as part of a pan-European crackdown on carbon credit VAT tax fraud.” And VAT, a valued added tax, is being advanced in the United States as a way to raise money to pay off our ever increasing debt.

“Last December,” reported IBD, “Europol, the European criminal intelligence agency, announced that Emissions Trade System fraud had resulted in about five billion euros in lost revenues as Europe’s carbon traders schemed to avoid paying Europe’s VAT and pocket the difference. In announcing the raid, the agency said that as much as 90% of Europe’s carbon trades were the result of fraudulent activity.”

The entire global warming theory has been a scam, a hoax and a fraud from the day it was first put forth. Its advocates, corrupt scientists, corrupted science journals, and all of the environmental organizations are hoping the same Congress that foisted Obamacare on Americans will do the same with Cap-and-Trade.

Tuesday, May 11, 2010

Buffett defends Goldman, joins greed Conspiracy:

By Paul B. Farrell, MarketWatch

http://www.marketwatch.com/story/buffett-defends-goldman-joins-greed-conspiracy-2010-05-11

May 11, 2010, 3:33 a.m. EDT

ARROYO GRANDE, Calif. (MarketWatch) -- Warning: Bears taking over. Time to short Buffett's new "Baby Berkshires," short Goldman, short Moody's and other favorites of Uncle Warren.

Why? Behind the façade, the lovable, good ol' Uncle Warren strumming his cute little ukulele, ostensibly supporting reform, there's a dark force that's part of the toxic Goldman Conspiracy fighting to keep alive everything that's wrong with Wall Street, everything that got us into this mess, everything that will trigger another meltdown that even Uncle Warren says: "I can guarantee it."

Buffett belongs to the past while the news screams of a new world order ... Riots in Greece, more coming when the other PIIGS demand EU bailouts ... conservatives regain Britain ... unregulated BP's greed is spilling millions of gallons of oil destroying Gulf states, confirming Foreign Policy magazine warning of the "End of the Age of Oil" ... the Dow's techno-fear-driven irrational 1,000-point plunge as technicians turn bearish, ending the year-long bull rally ... even Hank Paulson's changing his tune, warning the Financial Crisis Commission that we need stronger reforms than Dobb's Senate bill.

Meanwhile, out there, seemingly oblivious of the gathering storm is an aging Woodstock hippy, good Ol' Uncle Warren strumming away on his ukulele, an over-the-hill rock star basking in the adulation of 40,000 adoring shareholders at their annual meeting in Omaha's Qwest Center ... a scene reminding us of Nero fiddling as Rome burns ... of the string quartet playing on the deck of the sinking Titanic ... of a Shakespearean tragedy with a raging, blind King Lear trapped, in denial of his role in America's collapsing empire.

Yes, folks, Uncle Warren has a bad case of denial. Remember, not too long ago Buffett was calling derivatives "weapons of financial mass destruction." And yet, there he was on stage at his love fest last week defending Wall Street's most toxic companies, trapped in denial, defending the greedy culture that got America into its current mess:

Praising Moody's "business mode," and by inference all rating agencies that blindly rubberstamped Wall Street's toxic debt, setting up the last meltdown

Defending Goldman Sachs bad behavior despite the fraud suit and a possible criminal indictment (while hiding his own conflicts of interest as a big investor in both Moody's and Goldman)

Praising Goldman's CEO Lloyd Blankfein ... by far Wall Street's greediest fat-cat banker who paid himself $68 million of his stockholders profits last year

Defending Goldman with a bizarre argument that Goldman is no more guilty than the other Wall Street banks, a tacit approval of the bad behavior of all Wall Street banks in the Goldman Conspiracy

Worse, ol' Uncle Warren also tried deflecting attention from Wall Street's corrupt business model by blaming government regulators for the meltdown, another example of Uncle Warren's blind denial, ignoring the fact that in the past year Wall Street spent over $400 million on lobbyists and campaign cash to make absolutely certain regulators, Congress and the Obama team all played along with Buffett's songs that guarantee Wall Street controls Washington regulators

Ironically, all this comes from a man who once lectured Congress on "Moral Integrity: I want employees to ask themselves whether they are willing to have any contemplated act appear on the front page of their local paper the next day, read by their spouses, children, and friends ... Lose money for my firm and I will be understanding; lose a shred of reputation for the firm, and I will be ruthless"

Yes, Buffett's in denial ... just like his banker buddies ... so short Buffett, short Baby Berkshire, short Goldman, short Moody's. Why? They are all "shorting America," piling on debt that's pushed our debt-to-GDP ratio to 92%, past the IMF's 90% danger zone.

Main Street's also in denial ... forget hedger John Paulson's crooked subprime deals that made him and Goldman billions ... forget the hedgers in Michael Lewis' new "The Big Short" ... it's not the hedgers shorting America, it's the bosses inside Wall Street banks, their greedy co-conspirators inside Washington and now Uncle Warren, a nice guy who once thought derivatives were evil "weapons of financial mass destruction," but who's now defending every weapon Wall Street will use to stay in "business as usual," beating Main Street's 95 million investors, a corrupt business model destroying from within.

Wall Street's denial is blinding: Buffett and his merry band can no longer see how blind they are. They just keep strumming the same ol' tunes. Well folks, until they stop shorting America, we'll just keep reminding you of the debt their business model is creating.

So here are my best estimates, mostly from reported resources, of the huge debts Wall Street is dumping on America, the big bubble they're already blowing, driving the global economy headlong into another meltdown that will trigger the Great Depression II. And likely, with all this debt, soon you can bet taxpayers will stage a revolution making Main Street American streets far worse than Athens:

1. Federal government debt ... $14.3 trillion

Federal debt limit doubled since 2005 to $14.3 trillion limit. Bush/Cheney wars pushed U.S. deep into a debt hole. Military kills 54% of budget. Expect 4% deficits through 2020.

2. Treasury and Fed cheap-money policies ... $23.7 trillion

The Fed's shadowy printing presses have created an estimated but unaudited $23.7 trillion in credits, grants, loans and guarantees, backed by taxpayers. Pure profit.

3. Social Security's rising debt ... $40 trillion

Soon we must either cut benefits or raise taxes 40%. Delays worsen solutions. By 2035 Social Security and Medicare will eat up the entire federal budget, other than defense.

4. Medicare's unfunded debt ... $60 trillion

Going broke faster than Social Security. Prescription-drug benefit added an unfunded $8.1 trillion. In 5 years estimates rose from about $35 trillion to over $60 trillion now.

5. Annual health-care costs ... $2.5 trillion

Costs rising faster than inflation. Burden increasingly shifted to employees. Recent Obamacare plan would have cost $90 billion annually, paid to Big Pharma and insurers.

6. Secretive global derivatives trading ... $604 trillion

Wall Street resists all regulation of their gambling casino that leverages the combined $50 trillion GDP of all nations by a 12:1 ratio. Warning: Less than 2% of Wall Street's derivative bets triggered the last meltdown. Buffett "guarantees" it will happen again.

7. Population growth of 50% vs. Peak Oil demands ... $30 trillion

United Nations says global population is increasing from 6 billion to 9 billion by 2050. China and India need 500 new cities each. Billions more humans want autos, using up limited resources, shifting more costs to America, as commodity price increases and new resource wars.

8. U.S. dollar losing as reserve currency ... $20 trillion

As China's economy rockets past America's, the dollar will be replaced as the chief foreign reserves. The shift will devalue the relative worth of all America's assets.

9. Global real estate losses ... $15 trillion

Commercial real estate is bloating 25% of U.S. bank balance sheets. Dubai Tower, world's tallest, is empty. China collapse will upstage, further depress America's market.

10. Foreign trade and ownership ... $5 trillion

Foreigners own more than $2.5 trillion of America. China holds over $1 trillion Treasury debt. $40 billion new deficits added monthly. Total climbing at $400 billion annually.

11. State and local budget and pension shortfalls ... $3.5 trillion

Shortfalls of $110 billion in 2010, $178 billion in 2011. On top of more than $450 billion in annual shortfalls in local government employee pension funds. L.A.'s near bankruptcy.

12. Corporate pensions plus 401(k) plans ... $3.2 trillion

Only 30% of Americans have enough to retire. There's $2.7 trillion in 401(k) plans. And 92% of corporate pension plans are underfunded, with defaults guaranteed by taxpayers.

13. Consumer card debt ... $2.5 trillion

Americans are still living beyond their means. Even with a downturn, consumer debt rose from about $2.3 trillion to $2.5 trillion. Fat Cat Bankers love it, yes, love making matters worse by gouging cardholders and mortgagees, blocking help in foreclosures and bankruptcies.

14. Lobbyists annual costs ... $1.4 trillion

Wall Street bankers, Corporate CEOs and Forbes 400 Richest spend billions to influence elected officials, regulators and bureaucrats with lobbyists and campaign donations to exercise power over government. Voters are easily manipulated, but it takes lots of cash.

The total of all 14 categories of debt is a mind-blowing $825 trillion that includes "apples and oranges," jet fighters, derivatives and insurance fees, credit cards, autos and mortgages. There are more, and of course these are just estimates. Given the lack of transparency on Wall Street and in Washington, our debt is likely over $1,000 trillion.

What must you do? Wake up, drop your denial, get active, demand guys like Uncle Warren, his fat-cat buddies and Obama's team snap out of their denial, fight a return to the old greedy, toxic, destructive culture ... demand that your elected reps in Washington pass 1930's-style financial reforms ... or America will soon trigger a bigger meltdown, a new Great Depression II and no longer be the world's leading superpower.

Monday, May 10, 2010

High Frequency Terrorism: How the Big Banks and Federal Reserve Maintained Their Death Grip Over the United States:

By David DeGraw & Max Keiser, AmpedStatus Report

Posted on Monday, May 10th, 2010 at 1:11 am

http://ampedstatus.com/high-frequency-terrorism-how-the-big-banks-and-federal-reserve-maintained-their-death-grip-over-the-united-states

The following article is the third-part of a six-part report titled: “The Financial Oligarchy Reigns: Democracy’s Death Spiral From Greece to the United States.” The full report is available here:

http://ampedstatus.com/the-financial-oligarchy-reigns-democracys-death-spiral-from-greece-to-the-united-states

III: Financial Terrorism Operations: 9/29/08 & 5/6/10

In the aftermath of Goldman Sachs’ public flogging before the world in Congress, and while under investigation, on the very day that Congress was voting on the “break up the too big to fail banks” amendment and cutting behind the scenes deals to gut the audit of the Federal Reserve, the stock market had its greatest sudden drop in history, plummeting 700 points in ten minutes - shades of September 29, 2008 all over again.

If you recall, back in September ‘08, as Congress was voting down the first bailout, the big banks made the market plunge a record 778 points in one day, fear and panic then led Congress to pass the bailout. Trillions of our tax dollars, the money that we desperately need to keep our society functioning over the long run, then went out the window and into the pockets of the very people who caused the crash.

What happened on September 29, 2008 will go down in history as one of the greatest acts of terrorism ever.

9/29/08 proved that when you have so much power concentrated in the hands of a few, you can manipulate a computer algorithm and make the market and economy go which ever way you want it to go. So on 5/6/10, just as the power of the big banks was threatened again on the floor of the Senate and a deal on auditing the Federal Reserve was being negotiated, in came a sudden and unprecedented ten-minute 700 point market drop. A precision-guided High Frequency Trading (HFT) attack to show Congress who’s boss.

If you think the massive sudden drop happened because one lowly trader hit one wrong button, if you actually believe that the entire stock market can plunge because of one mistaken key stroke by a low level trader, you are stunningly naïve. I hate to burst your bubble, but this was a direct attack.

In a market where 70% of all trades are executed by computer algorithms via High Frequency Trading (HFT), Goldman Sachs has the power to make the market crash or rise at will. In fact, Goldman has a major Weapon of Mass Destruction in its Program Trading monopoly of the New York Stock Exchange, as Tyler Durden described on Zero Hedge:

“Goldman’s dominance of the NYSE’s Program Trading platform, where in addition to recent entrant GETCO, it has been to date an explicit monopolist of the so-called Supplementary Liquidity Provider program, a role which affords the company greater liquidity rebates for, well providing liquidity, and generating who knows what other possible front market-looking, flow-prop integration benefits. Yesterday [5/6/10], Goldman’s SLP function was non-existent. One wonders - was the Goldman SLP team in fact liquidity taking, or to put it bluntly, among the main reasons for the market collapse….

… here is the most recently disclosed NYSE program trading data….

What is notable here is that of the 1.4 billion in principal shares, or shares traded for the firm’s own account, Goldman was the top trader by a margin of over 100% compared to the second biggest program trader.

We have long claimed that Goldman is the de facto monopolist of the NYSE’s program trading platform. As such, it is certainly the case that Goldman was instrumental in either a) precipitating yesterday’s crash or b) not providing the critical liquidity which it is required to do, when the time came. There are no other options.”

For further investigation, I turned to Max Keiser, who has written and authored similar Program Trading and HFT computer algorithms. I asked him if he thought this was an attack, here is what he had to say:

“May 6th was an unequivocal act of domestic financial terrorism in America. A day that will live in infamy.

To scare the lawmakers, themselves large owners of the very banks and stocks that they are supposed to be regulating, a financial Weapon of Mass Destruction was put to their head and they acquiesced.

As the inventor of the continuous double-auction, market-making technology (VST tech. US pat. no. 5950176) that is referenced 132 times by program trading and HFT patents since 1996, I can tell you that Goldman, JP Morgan and the gang simply pulled the ‘buys’ from their computer trading programs and manufactured a crash. And when the coast was clear, and it was clear the politicians were not going to vote for anything that would break up the ‘too big to fail’ banks; all the ’sells’ were pulled from the computers and the market roared back.

This is a Manchurian Candidate market where program trading bots start the ball rolling in whatever direction Wall St. wants the market to go - and then hundreds of thousands of day-traders watching Cramer on CNBC jump on the momentum bandwagon and commit the crime for the Wall St. financial terrorists, who then say, ‘It wasn’t us, it was ‘the market!’”

On Friday, the next day, after the “break up the too big to fail banks” amendment was soundly defeated by a 61 to 33 margin in Senate and a deal was struck to eliminate key provisions from the audit of the Federal Reserve bill, Goldman was meeting with the SEC to work out a settlement in their case against them. Once again, Goldman proves that crime pays. Welcome to the New Mafia World Order.

Other than the two major operations carried out on 9/29/08 and 5/6/10, we must also recall a smaller attack on January 21st and 22nd of 2010, when Obama had a press conference and came out in favor of the Volcker Rule, which would have limited these HFT and “proprietary trading” schemes. At that time, the market dropped 430 points. Soon after this attack, all follow up talk on the Volcker Rule faded away and this reform has not been seriously addressed by Obama since then.

The bottom line, the United States has been taken over by a financial terrorism network. Let’s face it, we are all hostages of these financial terrorists and our puppet politicians rather be in on the scam than defend our interests. If these terrorists don’t get their way at all times, they have the power to throw their tremendous weight around and turn millions of lives upside down in a matter of minutes, and as they have shown they have no hesitation in executing that power, no matter how many millions of lives they destroy.

They set off this crisis with a wave of bombings in their initial Economic Shock and Awe campaign two years ago, resulting in massive devastation. Just to name a few of their greatest hits within the U.S.:

* 50 million Americans are now living in poverty, which is the highest poverty rate in the industrialized world;

* 30 million Americans are in need of work;

* Five million American families foreclosed upon, 15 million expected by 2014;

* 50% of US children will now use a food stamp during childhood;

* Soaring budget deficits in states across the country and a record high national debt, with austerity measures on the way;

* Record-breaking profits and bonuses for themselves.

Like other terrorists, they don’t use IEDs, they use CDOs. They don’t use precision laser-guided missiles, they use High Frequency Trading. They don’t have WMDs, they have derivatives. Let’s also not forget that they have toxic assets and dirty debt bombs just waiting to be deployed upon the American public once there is any true growth in the economy. Their nuclear arsenal includes hundreds of Trillions in secretive derivatives and hidden debt bombs, just ticking away, waiting to be set off… at their whim...

Sunday, May 9, 2010

VIDEO - Fundamental & Technical Analysis of the S&P 500's Daily & Weekly Charts:

http://www.viddler.com/explore/zigzagman/videos/19/

Here is the end of the week Technical Analysis of the S&P 500's daily and weekly charts, plus a look at the important Economic and Earnings Reports due out next week...

Happy Trading this week...

zigzagman

Saturday, May 8, 2010

Is Goldman Sachs the Anti-Christ?...

The Daily Bell

Saturday, May 08, 2010

http://www.thedailybell.com/1035/Goldman-Sachs-the-Anti-Christ.html

This debate is going to be crystallised in the Goldman case. Much of America is going to reflexively insist that Goldman's only crime was being smarter and better at making money than IKB and ABN-Amro, and that the intrusive, meddling government (in the American narrative, always the bad guy!) should get off Goldman's Armani-clad back. Another side is going to argue that Goldman winning this case would be a rebuke to the whole idea of civilisation – which, after all, is really just a collective decision by all of us not to screw each other over even when we can. It's an important moment in the history of modern global capitalism: whether or not to move forward into a world of greed without limits. – UK Guardian/Matt Taibbi

Dominant Social Theme: Goldman bad. Very bad.

Free-Market Analysis: We always have to start these articles off with the requisite nod to the fierce Gods of Ancient (and Modern) Days. So let's get it out of the way. Here goes ... Goldman is a horrible, smug, abusive institution with obvious ties to the power elite. It may indeed be the heart of darkness on Wall Street, the instrument through which the elite maneuvers as it plies its mercantalistic trade.

But the key word here is mercantilism. More than almost any other firm, Goldman sits at the intersection between government and private industry in America. That's how it makes its money. By using and abusing the laws of the land to line its own pockets. However, apparently, that is not a conversation that Americans can have anymore. Thomas Jefferson would have it – and often did have it both privately and in the presence of others.

American Founding Fathers generally understood (maybe with the exception of Alexander Hamilton) that the best government is the government that governs least. Matt Taibbi, who is a very talented journalist and writer, seems only to understand that government should act as a "boot stamping on the face of Goldman Sachs – forever." (Apologies to George Orwell.) This article appeared in the UK Guardian late April, but given all that is happening on Wall Street these days (and Taibbi's general relevance), an analysis seems fairly timely to us.

One of the problems from our point of view is that even if one grants that government can find the right face to stamp, there is no guarantee that ten years from now government will not be stamping on YOUR face. You may derive a great deal of satisfaction from using the regulatory levers of government to pry triumphant justice – dripping with gore – from the chest cavity of Goldman Sachs, but maybe (just maybe) you are fooling yourself or setting yourself, your family and your country up for an abusive situation. Here's some more from this brilliantly polemical piece:

Will Goldman Sachs prove greed is God? ... The investment bank's cult of self-interest is on trial against the whole idea of civilisation – the collective decision by all of us not to screw each other over even if we can ... So, the world's greatest and smuggest investment bank, has been sued for fraud by the American Securities and Exchange Commission. Legally, the case hangs on a technicality. Morally, however, the Goldman Sachs case may turn into a final referendum on the greed-is-good ethos that conquered America sometime in the 80s – and in the years since has aped other horrifying American trends such as boybands and reality shows in spreading across the western world like a venereal disease.

When Britain and other countries were engulfed in the flood of defaults and derivative losses that emerged from the collapse of the American housing bubble two years ago, few people understood that the crash had its roots in the lunatic greed-centered objectivist religion, fostered back in the 50s and 60s by ponderous emigre novelist Ayn Rand ... Here in the States, her ideas are roundly worshipped even by people who've never read her books or even heard of her. The rightwing "Tea Party" movement is just one example of an entire demographic that has been inspired to mass protest by Rand without even knowing it.

Last summer I wrote a brutally negative article about Goldman Sachs for Rolling Stone magazine (I called the bank a "great vampire squid wrapped around the face of humanity") that unexpectedly sparked a heated national debate. On one side of the debate were people like me, who believed that Goldman is little better than a criminal enterprise that earns its billions by bilking the market, the government, and even its own clients in a bewildering variety of complex financial scams.

On the other side of the debate were the people who argued Goldman wasn't guilty of anything except being "too smart" and really, really good at making money. This side of the argument was based almost entirely on the Randian belief system, under which the leaders of Goldman Sachs appear not as the cheap swindlers they look like to me, but idealised heroes, the saviours of society.

In the Randian ethos, called objectivism, the only real morality is self-interest, and society is divided into groups who are efficiently self-interested (ie. the rich) and the "parasites" and "moochers" who wish to take their earnings through taxes, which are an unjust use of force in Randian politics. Rand believed government had virtually no natural role in society. She conceded that police were necessary, but was such a fervent believer in laissez-faire capitalism she refused to accept any need for economic regulation – which is a fancy way of saying we only need law enforcement for unsophisticated criminals. Rand's fingerprints are all over the recent Goldman story.

For us, Matt Taibbi (despite his polemics) ends up in such articles being an apologist for the system as it is. He apparently supports the SEC prosecution of Goldman Sachs for various civil crimes as part of what he perceives as elemental fairness. But does Taibbi know what the SEC really is? Has he studied it? Does he understand that Wall Streeters smirk that the SEC is part and parcel of a larger "regulatory capture" by the Street and that many of the SEC's ambitious staffers dream of going to work on Wall Street for fat paychecks. The insanely elaborate regulatory system in America NEVER does what it is supposed to. It is not only dysfunctional but actually organized so as to raise barriers of entry to the securities business. The ONLY thing that SEC prosecution of Goldman will really end up doing is raising more barriers, which will further empower Wall Street's largest banks.

And how can someone as bright as Taibbi not understand that Wall Street itself is a creature of central banking. Without central banks money flows and economic euphorias brought on by the over-printing of money, Wall Street would likely not exist as such an attractive money magnet. Add in regulation, beginning in the 1930s after the great depression, and you have monstrous mish-mash that empowers the powerful, concentrates capital in certain investment entities and generally works to strip Americans of their wealth and hopes once every business cycle (every 10-20 years). The regulatory structure of America, when combined with mercantilist central banking itself, is the prime facilitator of this horrid system.

Taibbi might have a point about Rand if it weren't for the central banking and regulatory structure that surrounds Wall Street and empowers it. Wall Street is actually as far from Rand's idea of independent, laissez-faire self interest as it could possibly be. Every part of Goldman's business is based to one degree or another on federal laws and regulations. We would bet at this point in the history of US "free-markets" that you could not find a SINGLE transaction in which Goldman participates in that does not have some sort of regulatory color.

Taibbi is just like Simon Johnson in our book (see other article, this issue of the Bell) – blasting Wall Street and Goldman in particular without any regard to the larger frame of reference in which Goldman functions. Such analysis at this point in time is beyond naïve in our opinion. It verges on the manipulative. Does Taibbi really believe that the US government retains some sort of collective moral purity that is absent on Wall Street? No, Washington DC and Goldman Sachs are two sides of the same coin.

Because the mainstream media is the way it is, if there is a legal battle between Goldman and the SEC, the mainstream media shall probably partake of some of the positioning that Taibbi has already presented. The young lawyers at the SEC (yearning to work on Wall Street) will be presented as warriors for the aggrieved middle class and the young traders and bankers at Goldman shall be presented as Godless, greedy sociopaths.

Conclusion: Go on YouTube these days and watch videos of American civil and military authorities busting down doors and shooting family mutts while in search of dollar bags of marijuana, or throwing Canadian tourists in jail for not being polite enough when crossing the border, or tasering fans running across baseball fields. Read about the debates in the American congress over additional taxes for Americans and how the IRS is going to be equipped with shotguns, apparently to help with collections. Read about how Homeland Security is targeting American military veterans as potential terrorists, and those who participate in Tea Party protests, too. Go online and try to understand the ramifications and results of America's serial wars in the Mideast – the radiation poisoning from depleted-uranium weapons and the endless civilian killings. We understand that Goldman is a "great vampire squid" but what has the US government become? Taibbi defines civilization as "a collective decision by all of us not to screw each other over even when we can." What mirror is he looking in?

Friday, May 7, 2010

How China Holds the American Economy by the Balls:

By Scott Thill / AlterNet

May 3, 2010

http://www.alternet.org/story/146702/how_china_holds_the_american_economy_by_the_balls/?page=entire

America stays afloat selling billions of American dollars and Treasuries to our Chinese sugar daddy to keep our faltering consumer economy alive.

On May 1, China popped the cork on Expo 2010 in Shanghai, a months-long international celebration signifying the ascension of the city, and thereby its parent nation, as a global economic and cultural powerhouse. Meanwhile, in the United States, China's economic and cultural power has come under mounting fire.

Short-happy hedge funder Jim Chanos, who prophesied the fall of Enron, argued in April that the country's heated property market was on a "treadmill to hell." Foreign Policy followed suit by more or less blaming China's alleged currency manipulation, rather than America's own corporate and economic malfeasance, for exporting unemployment to the United States. Even our President Barack Obama jumped on the dogpile, expressing concern that China has not moved its currency to a "more market-oriented exchange rate," during an April meeting with Chinese President Hu Jintao in Washington. His administration stopped short, however, of releasing an April 15 report to Congress expressing this disapproval in concrete terms, choosing instead to trot out the disgraced deregulationist Larry Summers to soothe the Chinese that such matters will be taken up at future gatherings.

For its part, China has responded to the finger-pointing by the United States with its own middle digit.

"We oppose the practice of finger-pointing among countries or strong-arm measures to force other countries to appreciate currencies," Chinese Premier Wen Jiabao said in March, before restating his well-publicized 2009 worries that U.S. Treasuries are in trouble. "In the press conference last year, I said I was a bit concerned about it. This year, I make the same remark. I am still concerned. I hope the U.S. will take concrete measures to assure its investors."

Good luck with that, China. From resilient wage and unemployment stagnation to revelations of investment banks like Goldman Sachs selling "shitty" bundles of toxic mortgages to national and international suckers with one hand while clandestinely shorting them with the other, the United States is in no position to assure investors of anything. Which is why they've taken lately to crowing about China, rather than settling their own business at home. That business includes, of course, selling billions of American dollars and Treasuries to our Chinese sugar daddy to keep our faltering consumer economy alive.

"China holds about $820 billion U.S. dollars, and about $480 billion is in U.S. Treasuries," Stefan Halper, senior fellow at the Cambridge Centre of International Studies and author of the new book The Beijing Consensus, told AlterNet by phone. "China would not take steps to decrease the value of the dollar, because that would decrease the value of its own holdings. China doesn't want to bring the dollar down or the U.S. economy down, but it is benefiting from American consumers, who buy its exports. which represents about 60 percent of its economy per year."

Halper is firmly in the camp of those who are tagging China as a currency manipulator. In The Beijing Consensus, he argues that the rising 21st century superpower is suppressing the yuan, exporting unemployment and even standing in the way of America's lagging recovery from the global recession. In the process, Halper writes, China is also exporting its overall philosophy of economics and governance at the expense, pardon the pun, of our own.

"Beyond everything else that China sells to the world, it functions as the world's largest billboard for the new alternative of 'going capitalist and staying autocratic,'" Halper explains in The Beijing Consensus. "Beijing has provided the world's most compelling, high-speed demonstration of how to liberalize economically without surrendering to liberal politics."

Of course, he admitted, China couldn't have done it alone. America was more than happy, drunk on deregulation and war, to dig its own grave.

"The disastrous involvement in Iraq and Afghanistan have just depreciated the American story and the American example," Halper told AlterNet. "You can look at the Pew data: There has been rising disapproval of the U.S. since Bush put us into those two wars. Plus, the Washington Consensus proved not to be a good form of Third World development, which opened the door to Chinese offers of low-interest loans and non-interference. So yeah, we've done things poorly. We've had a recession, and an inability to regulate our markets. We're certainly not perfect."

That's probably the understatement of the new millennium. Viewed through that prism, the argument that our preeminent funder is somehow partially responsible for our own extensive economic troubles is disingenuous, even if esteemed economists like Paul Krugman have been sipping the blame-China Kool-Aid. What's gets lost in the financial wonkery -- or wankery, if you will -- is the fact that, through our own corruption and greed, we have willingly pushed nations into the arms of China rather than earn their trust. Through the misguided Washington Consensus, we and others tried and succeeded at establishing a rapacious list of interventionist measures -- concretized as "stabilize, privatize, and liberalize" by Harvard professor of international political economy Dani Rodrik -- since the 1990s that has ultimately culminated in our current lunacy. To argue at this late stage of the game that China is partially to blame for this is playing the kind of crappy defense that loses championships in pro sports. It shows, above all, that we have no game.

"China will make decisions in its own interests, just as the U.S. does," Rachel Ziemba, senior analyst for China and oil-exploring countries at Roubini Global Economics, told AlterNet. "It's actually in China's interest in the mid-term to have a more flexible exchange rate as it increases their monetary policy autonomy and could boost domestic purchasing power, helping domestic consumption. It also could help control domestic inflation. But domestic dictates, not U.S. pressure, will determine Chinese policy moves in this area. Chinese authorities are balancing different economic pressures, and an appreciation of the currency would increase the price of Chinese exports."

Like Halper, Krugman and more, Ziemba thinks that China is indeed a currency manipulator. "The pace of foreign-exchange reserve accumulation implies that the Chinese central bank is intervening heavily in the foreign-exchange market, implying that, yes, it is manipulating its currency."

In that, it's not very different than anyone else playing the currency game, including the United States. Except that it's deftly playing the pegging game -- to the dollar, then to a managed float in 2005, then back again to the dollar during the crisis -- for the benefit of its nation, rather than a select few banks, funds and other entities. It's in it to win it. For everyone, depending on who you ask.

"The bulk of China's foreign exchange reserves are recycled into dollar-based assets, which helps fund the massive U.S. savings shortfall," Morgan Stanley Asia's Stephen Roach wrote in a Council on Foreign Relations roundup called "Is China a Currency Manipulator?" "Who might deficit-prone Washington turn to if it shuts off the Chinese funding spigot? At a minimum, reduced buying by America's largest foreign lender would spell sharp downward pressures on the dollar and/or higher long-term U.S. interest rates -- developments that could well trigger the dreaded double dip in the U.S. economy."

In other words, China is keeping its eye on the prize -- its own economic and political survival -- while the rest of the world, from the United States to the European Union treads water. And why not? A modest accounting argues that China's economy expanded at over 10 percent in the first quarter of 2010. Meanwhile, U.S. real gross domestic product probably grew around 3 percent in the same period.

"We believe consumer spending is being buoyed by a variety factors that will not be maintained over the long term," Ethan Harris, chief North American economist for Merrill Lynch, told MarketWatch in late April. "Even with the recovery in net worth, households have essentially lost 15 years of saving."

"Many countries have imbalanced economic systems," Ziemba told AlterNet. "China's economy has low external debt, which is a big plus, but the contingent liabilities of the government have increased as bank loans have increased. Yet with deposits having climbed as much as loans, China's banking system is well capitalized."

In the final analysis, complaints about China's financial practices should be properly contextualized, especially when those lodging the complaints have done more to disrupt global financial practices than anyone else. Perhaps when those complainers have settled their own accounts -- with vampire squids like Goldman Sachs and JP Morgan Chase, or the print-happy Federal Reserve Bank, or the Supreme Court that recently ruled that corporations possess the same rights as people -- then their whining about China's currency manipulation should be taken a bit more seriously. But not sooner.

"To the question of American excess and inability to regulate our financial markets, you're right," agreed Halper. "We have fallen down on that, and the Chinese have taken the opportunity to extol their model. But you've got compare China over time. What you see is two things: A rising middle class with a strong commercial material culture, and a highly repressive iron hand on the part of the central government. And that really is the most fascinating thing we see today. It's not classical communism. It's in business to perpetuate its own power, and we have to come to grips with it."

Sure, no problem. But only after we come to grips with the business of perpetuating our own power first. Change begins, after all, at home.

Wednesday, May 5, 2010

America at the Crossroads - and the War on Gold:

Darryl Robert Schoon

Posted May 4, 2010

http://www.321gold.com/editorials/schoon/schoon050410.html

Every so often a philosophical dilemma becomes real. So it is today. For two thousand years, the message of Christ Jesus influenced and informed the West, if not in deed, then in word. Today, that is no longer so. Today, godless capitalism is threatening to supplant the two millennia reign of Christ's message of brotherly love - if not in word, then, certainly, in deed.

In times of great change, art reflects social and philosophical undercurrents. The movie, Avatar, is an example of this phenomenon as was the movie, Wall Street, in 1987. Gordon Gekko, Oliver Stone's protagonist in Wall Street probably didn't read much; but, if he did, a book such as A Utopia of Greed: Ayn Rand's Moral Defense of Capitalism could have been on his reading list.

One of Gordon Gekko's more memorable lines is Greed, for want of a better word, is good. Greed is good is also one of Ayn Rand's fundamental beliefs; and, if Karl Marx is the father of godless communism, Ayn Rand, America's premier doyenne of selfishness, is the patron saint of its antagonist, godless capitalism.

Alisa Rosenbaum was born in Russia in 1905 where she would later change her name to Ayn Rand. In her youth, she would become an atheist, a belief she would hold for the rest of her life. No other self-proclaimed atheist would achieve such a large following - except perhaps Karl Marx; additionally, no other writer would be as responsible for giving philosophical cover to the selfishness and greed that would later characterize American-style "laissez-faire" capitalism.

Ayn Rand saw selfishness and greed as virtues; and, to their later disgrace, so, too, did many others.

Ba'al: the Golden Calf of Capitalism Grows Up:

When Ayn Rand died in 1982, a six foot floral wreath in the shape of a US dollar was laid by her casket; a symbol that was to be ironically appropriate as Ayn Rand's death would precede the demise of the US dollar by only a few short decades.

Nothing exemplified the effect that Ayn Rand's philosophy would have on America as much as the movie, Wall Street. Released in 1987, it reflected the values that would be responsible for America's moral decline over the next 30 years. This 45 second clip from Wall Street is chillingly revelatory:

In September 2010, Oliver Stone's sequel to Wall Street, Money Never Sleeps, is scheduled for release with an older but still unrepentant Gordon Gekko. After the 1980s, greed did not go away in America - it flourished.

AYN RAND, GOLDMAN SACHS & GOD:

Nowhere was Ayn Rand's influence felt more than on Wall Street. The selfishness and greed that Ayn Rand exalted found a natural home among Wall Street banks, especially Goldman Sachs where Senior Partner Gus Levy succinctly summed up Goldman's strategy as long term greed. It was a mission statement Ayn Rand could be proud of.

It is incorrect, however, to attribute Wall Street's greed solely to Ayn Rand. Greed and selfishness existed long before she posited the two vices as virtues, just as free markets existed long before capitalism was illegitimately birthed in a manger of paper money at the Bank of England in 1694.

Ayn Rand's writings are nonetheless responsible for giving greed and selfishness the sheen of respectability they previously lacked, especially among the bespoke jackals that serve our currencies back to us in the form of loans.

In defense of today's bankers, Goldman Sachs CEO Lloyd Blankfein recently stated, We are doing God's work; and, so, they are, if capitalism's culling of the trusting, vulnerable and less fortunate is included in Blankfein's novel definition of God's calling.

[I] managed to sell a few [worthless] abacusbonds to widows and orphans that I ran into at the airport.. not feeling too guilty about this, the real purpose of my job is to make capital markets more efficient. email, 6/13/2007, Fabrice Tourre, vice-president Goldman Sachs

If it is God for whom Blankfein toils - at enormous compensation, i.e. $68 million in 2007 - it is not the God of the New Testament where Christ Jesus admonishes us to be our brother's keeper. It is the Hindu God, Shiva, the destroyer and transformer for whom Blankfein puts in overtime; and in that capacity he has done yeoman's work for which he is to be congratulated.

Goldman Sachs, more than any other bank, under Blankfein's leadership has played a central role in destroying capitalism, i.e. economies based on bankers' debt-basedcapital, a parasitoidal system bankers designed to indebt productivity and commerce for profit until society collapses.

PAPER MONEY - GOLD = PAPER

SHIVA'S DANCE OF CAPITAL DESTRUCTION:

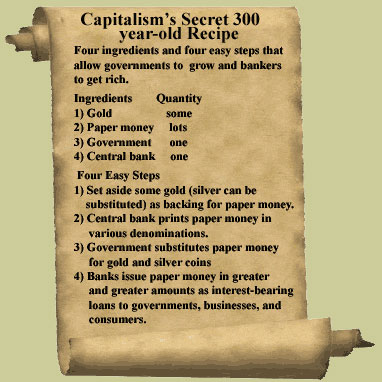

While Lloyd Blankfein's contribution to capitalism's demise should not be minimized, capitalism's current problems actually began in 1971 when gold, one of the four essential ingredients in the bankers' brew of debt-based money, was eliminated from the classic formula that had served bankers and governments so well for so long.

Capitalism's recipe insures government's infinite growth as government access to central bank credit is unlimited and bankers will profit from loaning paper money into perpetuity.

When gold was removed from paper money in 1971, this simple yet powerful recipe for capitalism's success was fundamentally altered and so, too, would be capitalism. It would only be a matter of time until capitalism sans gold would falter.

Lloyd Blankfein, Robert Rubin, Lawrence Summers and Alan Greenspan et. al., individually and collectively, would only hasten the process. Lord Shiva's dance of capital destruction was already underway; because without gold, the illusion of paper money as money is only an illusion. Without gold, paper currencies are only coupons with expiration dates written in invisible ink.

To call capitalism a monetary system is a misnomer. It's a financial shakedown, a scheme whereby bankers profit by inserting debt into every aspect of human activity. Eventually, everyone becomes indebted beyond their capacity to repay and the system collapses.

The bankers' indebting of others eventually will end in their own demise, with governments, businesses, and consumers drowning in debt and banks insolvent. Capitalism is an economic parasitoid, a parasitic system where parasite and host both expire.

A parasitoid is an organism that spends a significant portion of its life history attached to or within a single host organism, which it ultimately kills (and often consumes) in the process. Thus they are similar to typical parasites except in the certain fate of the host.

http://en.wikipedia.org/wiki/Parasitoid

As with all life-forms, parasitoids will do everything to insure their survival while blind to the fact it is their actions that will destroy them. Until its self-inflicted end, capitalism will struggle to survive and expand - and a part of that struggle is the bankers' war on gold.

THE WAR ON GOLD:

The IMF.. explicitly states in its Articles of Agreement that member countries are prohibited from tying their currencies to gold.

Gold Wars, Ferdinand Lips, The Foundation for the Advancement of Monetary Education, New York

In 2001, Ferdinand Lips published Gold Wars, his book that describes the bankers' ongoing war on gold. That Lips, a Swiss banker, would write such a book is to our benefit as the Swiss have a unique, historical, and deep respect for the monetary metal.

Curiously, Lips had earlier been an agent for the infamous Rothschild banking family. In 1968 he was co-founder and Managing Director of Rothschild Bank AG Zurich. As such, Lips had an insight into the world of gold that few had and some believe it would later cost him his life.

One story in Gold Wars is of particular interest as it involves John Exter, the extraordinary central banker (formerly vice-president in charge of international banking and gold and silver operations at the New York Federal Reserve), and Paul Volcker, later Fed chairman and erroneously believed by many to be a hero.

Exter's story shows Volcker in entirely different light, not as a hero but as the one responsible for the removal of gold from the monetary system. Volcker, according to Exter, played a central role in the decision to do so.

In Gold Wars (pp.76-77) John Exter tells Ferdinand Lips how the decision to demonetize gold was made: On August 10, 1971, a group of bankers, economists and monetary experts held an informal meeting... to discuss the monetary crisis. Around 3 o'clock in the afternoon, a big car rolled up with Paul Volcker in it. He was then Under-secretary of the Treasury for Monetary Affairs.

We discussed various possible solutions. As you would expect, I was for tight money - raising interest rates - but that was overwhelmingly rejected... As for raising the gold price, as I suggested, Volcker said it made sense, but he didn't think he could get it through Congress.

At one point, Volcker turned to me and asked what I would do. I told him that since he wouldn't raise interest rates and wouldn't raise the price of gold, he only had one option... he'd have to close the Gold Window... Five days later Nixon closed the Gold Window.

The final link between the dollar and gold was broken. The dollar became nothing more than a fiat currency and the Fed [and especially the banks] were then free to continue monetary expansion at will. The result... was a massive explosion of debt.

Paul Volcker, then, is the one who eliminated gold from capitalism's 300 year-old recipe for power and wealth. Karl Marx was right when he predicted that capitalism would destroy itself. We just didn't know it would be Paul Volcker who would pull the plug.

THE SLEDGEHAMMER THAT BROKE THE CAMEL'S BACK:

The explosion of debt allowed by Volcker's removal of gold in 1971 has now reached extraordinary levels. In 1971, US debt was $436 billion. Today, US government obligations exceed one hundred trillion dollars. Tethering the dollar to gold was the one constraint on US spending. Volcker eliminated that constraint thus enabling the US to indebt itself ad infinitum - and it did.

Debt, the inevitable effluvia of credit, is Shiva's final shiv in capitalism's back. But it is not the indebtedness of those the bankers indebted that are now causing capitalism's final paroxysms. It's the debts of the banker's themselves.

When US banking and financial interests repealed the Glass-Steagall Act, it reopened the doors to another depression, doors that had been sealed since the 1930s. Prior to its repeal in 1999, Congressman John Dingall (D-Mich) whose father helped write Glass-Steagall in 1933 warned:

What we are creating now is a group of institutions which are too big to fail... Taxpayers are going to be called upon to cure the failures we are creating tonight, and it is going to cost a lot of money, and it is coming.

Congressman Dingall's warnings were ignored by both republicans and democrats. The republican-sponsored bill to repeal Glass-Steagall was passed overwhelmingly in the House by both parties (362-57) and in the Senate (90-8) effectively enslaving America's future generations, gratis of a $300 million lobbying effort by banks and insurance companies.

The beauty of paper money is that it buys real power

Once again, both republicans and democrats sold out the nation's future and allowed banks to bet the savings of America, this time with obscene leverage of 40:1 and more. Not surprisingly when the banks bet the house and lost, the house collapsed.

Politicians can't be bought. They can only be leased.

When bankers couldn't cover their losses, governments came to their rescue and indemnified them with taxpayer money. But the trillions of dollars spent to rescue banks and restart capitalism's broken engine is not being levied on the banks. It's being levied on those who saved them. The current upsurge in sovereign debt is the cost of the bankers' crisis subsumed into national ledgers.

Recently, President Barack Obama went to Wall Street to ask for help in reforming the financial system. Asking Wall Street's help with financial reform is akin to Neville Chamberlain asking Hitler to assist in redrawing Europe's borders. The current effort is designed not to fix the system, but to continue it.

Avarice is never appeased. Greed is never satisfied and the fires that Ayn Rand inflamed will not subside until the house that fanned them and gave them shelter burns to the ground. The bankers have come too far to go back. There is only the road ahead - and it's a cliff.

SHIVA'S COMING MAKEOVER:

I end my articles with the words: buy gold, buy silver, have faith. Of the three, I believe faith to be the most important, the most valuable and the least understood. A strong and unwavering belief in an intellectual construct is not faith, though many believe it to be.